Modern Portfolio Theory FTW

(The thumbnail chart for this post shows the efficient frontier, aka Sharpe ratio.)

40 years ago, the mutual fund was a relatively new thing. It was this amazing way to diversify your investments, to spread risk, which is what all good investment professionals will tell you: never put all your eggs in one basket.

But… who picks those eggs, and how?

Enter Morningstar, which built revolutionary tools and data visualization around the mutual fund. One such revolutionary tool was called Portfolio Builder.

Portfolio Builder lets you choose individual stocks, look at their fundamentals, past performance, and other factors, and add them to a collection voila! You built your own model portfolio (not exactly a mutual fund, but close). If you were really good at stock picking, that portfolio did amazing. Go, you! Then you get to maintain it, rebalancing and choosing new stocks forever!

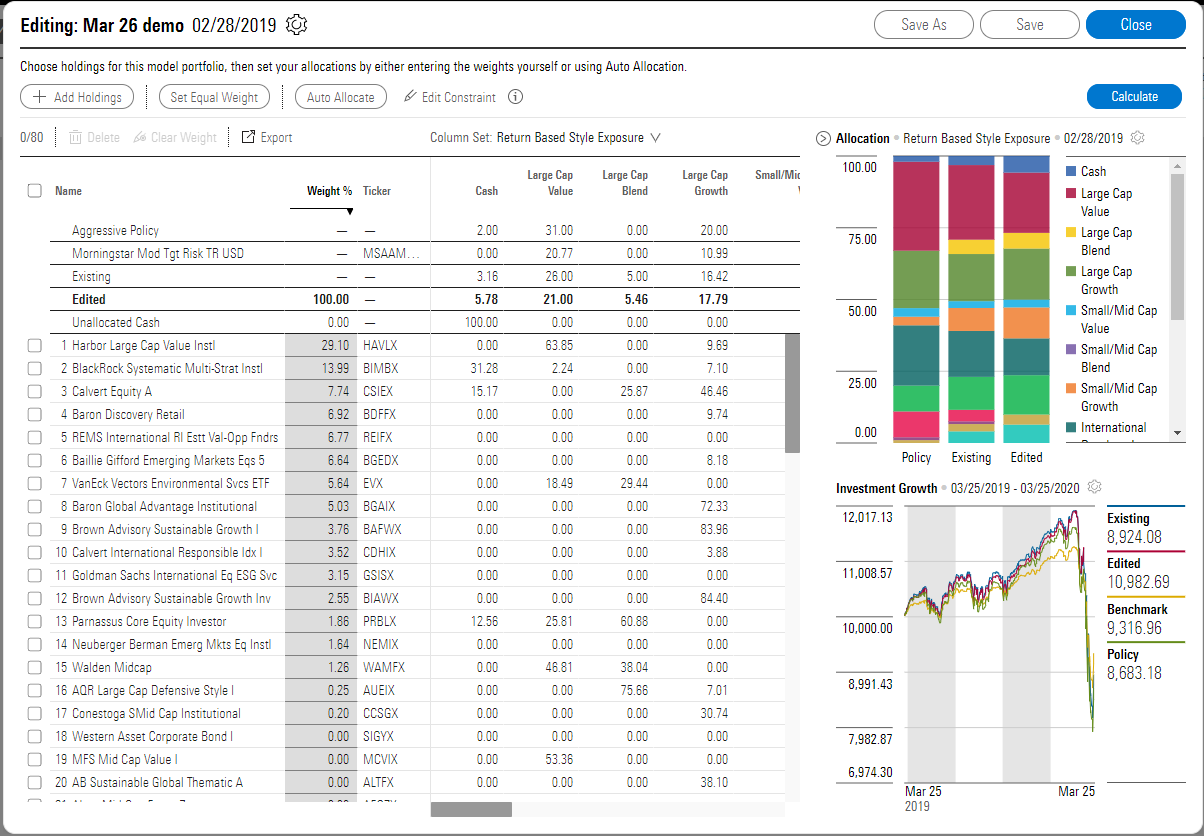

Here’s what it looked like:

A highly complex mutual fund portfolio tool

(Did I mention I started this work in February 2020?)

The most helpful part of the tool was the Allocation modeling at the top right, because it told you what sectors and categories you were adding and how they were balanced.

Fast forward forty years, and no one does it like this any more.

This was the challenge laid before me by the CPO — what would we need to do to bring Portfolio Builder up to date?

As I soon found out, the problem is no one does it like this any more.

In fact, the inverse is true of the process. Here’s what happens:

Model portfolio builders set up industry segments they want to add to their portfolio, like large cap, energy, and other criteria. They add return parameters like ESG rating, risk tolerance, and other factors like Sharpe, and they run a query against a database of stock performance which spits out what should be in your portfolio, how much, etc.

Basically, auto-balancing without human choice. It’s cleaner and better. It’s one way AI and machine learning can actually benefit investors.

People use a variety of tools to do this.

At Morningstar, analysts were using a monstrously slow Excel spreadsheet to build them. (Not the Portfolio Builder. When I asked, I heard “why would I do that?” a lot.)

So I set about designing what a portfolio builder would have to be able to do to adapt to new processes.

I should add that I had to deeply understand the factors involved in building a new model portfolio, how they affected one another, and how decisions got made by analysts to design this tool.

What did that look like? At the end of putting in all of your variables, it delivered this:

All along the way, the CPO was pleased with the work. It was clear I understood the problem and the design was graceful, it tested well, everyone understood how I was laying out performance and factors, etc.

But when he asked me what the plan was to make our current portfolio builder into this, I said what I had discovered by talking to the product owner: “we can use the data, but we can’t use the flows, UI or current backend code.”

Which infuriated him.

I laid out the progress the entire way. Nothing was a surprise.

I drew out the two flows that worked in reverse of one another: the old process was about building something from nothing, while the newer way was a process of elimination, working backward from a universe of all mutual funds and stocks.

I left Morningstar a month later.

The CPO was gone the month after that. It’s a hard place to feel successful.

Sad trombone, I know.

To some, that will look like a failure as a designer. I should have been able to persuade! Convince! Succeed! Spin up a new team! Get an investment!

Find a way to make Portfolio Builder work!

In that way, this is not a good piece of product design work, because there is no product at the end to show for it. Innovation that goes nowhere isn’t a success.

But… you want to know if I can redesign a current product that meets user needs in a hands-on way. Now you do. If there had been investment, I could have led the redesign easily. It was a proven idea, a proven flow.

Post Script

I found out much later that Morningstar is littered with ideas like mine, designs that were tested and valid but couldn’t be built without a serious reconsideration of the current technology. You have to have an appetite to do that in the c-suite.

It doesn’t fit with big bang quarterly announcements for a public company.

I also like to think that someday, someone will disambiguate the tech stack from the data that underpins it. Morningstar already sells its data to companies that have done just that.

And that’s the end of my sad tale. :)